Whether you are a person or business in a big city or small town, the right life insurance policy and the right life insurance carrier starts with the right life insurance agent.

By Meagan Baron

Tailoring your insurance policy so that you get the right coverage, carrier, and cost fit doesn’t stop at car insurance, home insurance, or business property insurance. Mosaic can also help you with your life insurance policy at home and/or at work.

In lieu of September being National Life Insurance Awareness Month, we gathered some facts about life insurance that you can apply to your personal life as a husband, wife, father, mother, etc.—as well as to your work life as a business owner or business partner. Take a look below at the different life insurance breakdowns and myth busting, and let us know if you have any questions or you are interested in exploring policy options.

What Are the Different Types of Life Insurance?

Some of the Different Types of Personal Life Insurance Mosaic Sells:

Below are some quick facts for you about life insurance for your personal needs. Click the links to learn more about the different types of life insurance. If you are interested in learning more about a coverage, fill out our simple and quick personal life insurance quote form and we will get in touch with you shortly.

- Individual Life Insurance: Mosaic can help you with term life insurance, whole life insurance, and universal life insurance for you and your family.

- What is the difference between term life insurance and whole life insurance? The main distinction between the two is that a term life insurance policy is only active for a certain timeframe, while a whole life insurance policy does not have a set time period. Learn more about the difference of term life insurance vs. whole life insurance on our individual life insurance page below the videos and interactive graphic.

- Child Life Insurance: No one wants to ever have to think about losing a child. But, if that devastating loss were to happen, a child life insurance policy can help during this grievous moment. For example, it can cover funeral costs, counseling, and leave from work. Outside of loss, it can also act as a type of savings security net for your child later in their life—such as college fees.

- High Net Worth Insurance: This coverage gives you expanded custom solutions to your unique risks, assets, and lifestyles that a standard individual life insurance policy does not typically provide. Like an umbrella policy for your home and auto, high net worth insurance gives higher coverage limits. In addition to that heightened coverage, it specifically takes in account unique needs of certain individuals—like a classic car insurance policy takes in account customized parts for a classic vehicle that a standard policy does not always do. Visit the product page for more information on its unique value.

- What is living benefits? (What is a living life insurance policy?) These terms are often used to describe how some life insurance policies have benefits that can provide financial support if the insured is diagnosed with a disability, terminal illness, chronic illness, or injury that requires them to have long-term care. Please note that not all life insurance policies have living benefits, but Mosaic Insurance works with some carriers who do offer such services.

- Personal Long-Term Care Insurance (LTC Insurance): To expand on the above, LTC coverage is designed specifically as a safety net if you were to develop a severe illness or become disabled. In addition to having long-term care coverage as its own policy, we can help you add a long-term care rider to a standard life insurance policy.

Some of the Different Types of Commercial Life Insurance Mosaic Sells:

- Key Person Life Insurance: This coverage is also know as key man life insurance or key woman life insurance. Like how a personal policy can help your spouse and children in the event of your death, key person life insurance can help your business stay afloat in the event that your business partner or an integral employee dies. Also, if you are not able to make ends meet in the long run, the insurance can at least help you slowly close operations so you can avoid immediate layoffs of every employee and forced liquidation of your business you worked so hard to build. Click the link to get a better understanding of what it has to offer to your business’ stability and future.

- Commercial Long-Term Care Insurance: Long-term care insurance for businesses can be an integral strategy for recruiting valuable employees. Seen as a quality employee benefit, business LTC insurance is also a key element in a comprehensive benefits package that can help retain good employees, keep them more productive in their duties, and help them remain determined in the workplace. (For specifics on what having a policy can do you your work atmosphere, view the interactive graphic towards the bottom of the product page.) Coverage for this policy is like that of the LTC personal policy mentioned above—it’s just an employer providing the benefit to the insured instead.

- Submit a request for a business life insurance quote today with our fast and easy quote form!

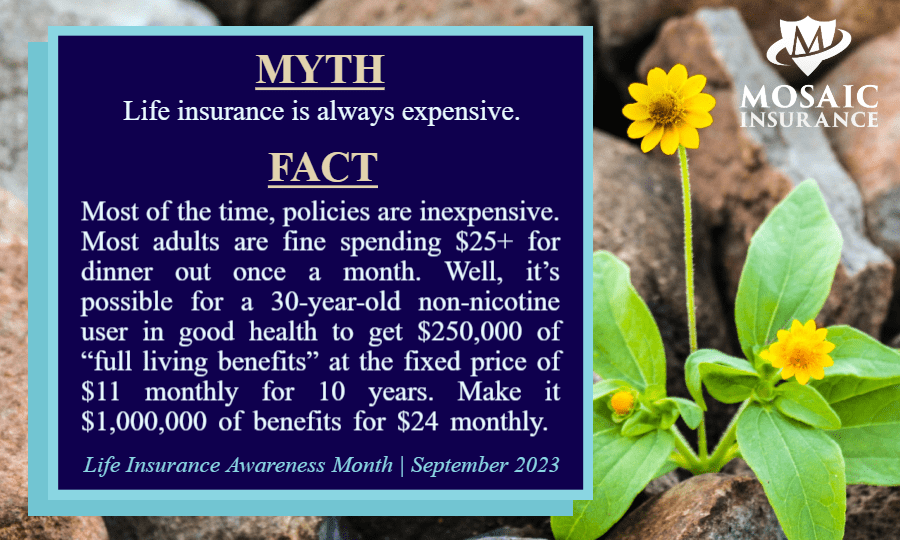

“But, Isn’t Life Insurance Expensive?’’

The above picture is one of the biggest life insurance myths that we want to debunk at Mosaic Insurance Alliance. And, that is not the only myth we hear a lot. Take a look at these common myths and let us know how many of them you used to believe!

It Doesn’t Hurt to Have Us Do the Footwork

You may not want a life insurance policy right now…but having us run a quote doesn’t hurt. You never know until you try, and quotes are free of charge. It’s our job to figure out what needs to be done to tailor a policy that meets your coverage needs and financial needs.

To do that, we will…

- Answer any question that you have.

- Shop around with the different carriers we do business with.

- Check for different discounts.

- Scout for policy options in your price range.

- Present you with our findings and see if you are interested in any alterations.

If you would like to have some more information before contacting us, take a look at these life insurance blogs and life insurance tips:

- Get a life insurance calculator and some facts right from real life insurance agents in our blog post How Much Life Insurance Do I Need?.

- Learn about the two main types of life insurance in piece Life Insurance 101.

We’re ready to answer your life insurance questions and explore different carrier and policy options for you! You can chat with us using our IM feature located at the bottom right corner of the screen, calling us at our mainline (425-320-4280), or emailing our office (info@mosaicia.com). You can also contact your Mosaic agent directly if you are already a client.