Tips for protecting your home and property when doing Airbnb

Airbnb has gotten a lot more popular over the years. With the coronavirus causing lost jobs, its popularity has skyrocketed even more as people are looking for new ways to make money.

Before you rent out your home on Airbnb, make sure that your insurance carrier allows it and that your policies do not have exclusions you’re likely to face. You might find that your carrier will not cover any claims, or that certain circumstances involving it, like theft, will not be covered. It is also important to know that Airbnb’s Host Guarantee is limited protection that Airbnb offers for certain circumstances in the event that hosts refuse to pay for damages they caused…It is NOT an insurance policy!

Why should I get Airbnb insurance?

You never know who you will be renting to. Carelessness, criminal activity, and accidents happen every day. Having insurance helps protect you and your assets. Replacement costs and home repairs can add up. You can also face lawsuits if someone is hurt or you are seen at fault for causing damages to another’s property. Having the right insurance can help pay for not only your property loss, but also for the property of others, costly medical bills, and legal counsel. The bottom line: it is better to be safe than sorry.

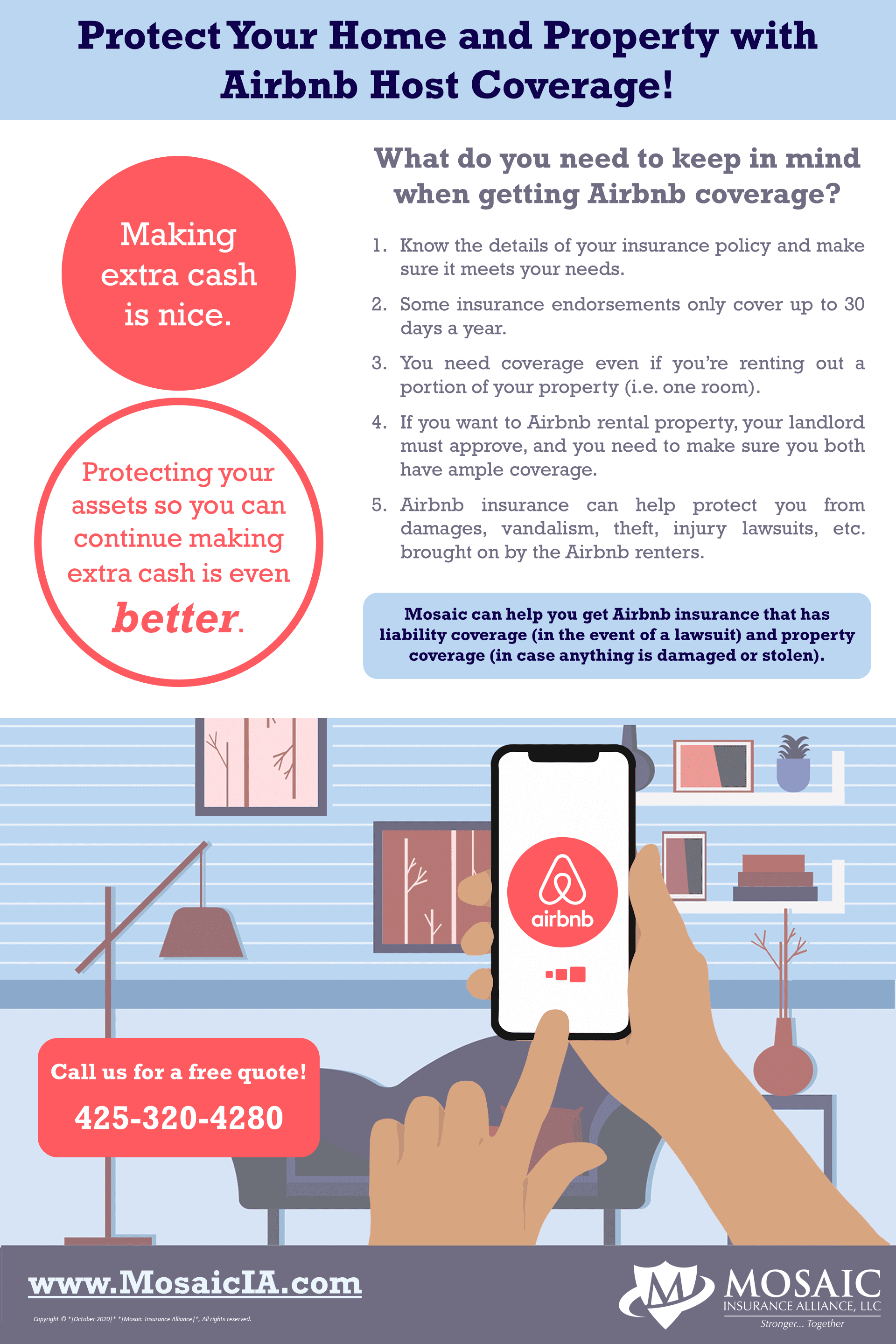

What do you need to keep in mind when getting Airbnb coverage?

- As always, it is important to know the details of the policy and to get insurance coverage through a carrier that meets your needs. For example, did you know that some insurance companies will provide only an endorsement to cover up to 30 days a year for Airbnb host coverage? If you plan on renting out something like your summer home, 30 rental days per year is most likely not enough time for you.

- It is also important to know that even if you are renting out just a portion of your property, like a single room, you will need to have coverage and you should get in touch with your agent prior to renting.

- Additionally, if you want to Airbnb rental property, you will have to approve it first with your landlord and make sure that their policies and yours have ample coverage and will accept Airbnb.

- Lastly, it is important to keep in mind that you will not be there to monitor situations. You are trusting someone to take care of your property while you are away. And, with Airbnb, usually that someone is a person that you have never met before…Airbnb insurance can help protect you and/or your landlord against damages from carelessness, vandalism, theft, etc. brought on by the Airbnb renters. Mosaic can help you get Airbnb insurance that has liability coverage (in the event of a lawsuit) and property coverage (in case anything is damaged or stolen).

What insurance companies will cover my Airbnb home?

There are numerous companies out there that provide Airbnb host insurance. We can find you an insurance carrier that will meet your Airbnb needs.

As an independent insurance agency, we have access to many carriers, some of which have advanced Airbnb programs. For example, one of our carriers, Travelers, has extensive and flexible options for Airbnb renters—read about Travelers’ Airbnb coverage in our blog post here. For more options, and to see which insurance carrier is the best fit for you, reach out to us! We will be happy to give you a free quote. You can fill out our home insurance free quote form, call us at (425)-320-4280, or email us at info@mosaicia.com.

Know someone who does Airbnb a lot?

Do you have a friend, family member, neighbor, coworker, client, etc. who uses Airbnb a lot? There might be something about the insurance side of things that thy do not know! You can send them our blog post via a link or send them this infographic for some quick and important information! Click here to view/save the PDF.