Mosaic Insurance Alliance has ballpark costs for different coverage securities & loss control steps for cannabis retail stores!

There has been a huge spike lately in cannabis property crimes across Washington’s Puget Sound and Oregon’s Portland areas. All you have to do is turn on the 5 o’clock news and you will hear all kinds of stories about the recent cannabis retail shops that have been robbed, burglarized, and/or vandalized. And, it doesn’t stop in Oregon and Washington. As Ganjapreneur reports, the recent cannabis crime wave is spreading rapidly across the West Coast, including California in places like San Francisco and Oakland.

Are you a cannabis retailer? Mosaic Insurance Alliance helps all kinds of marijuana stores with cannabis commercial insurance—those who sell CBD topicals, marijuana vape pens, pipes, and other cannabis goods. We know how important your company is to you and how airtight your business insurance needs to be in order to have a covered insurance claim.

As a cannabis business owner, what can you do to protect the business that you worked so hard to build?Mosaic has been in the cannabis insurance industry since 2012. Over the years, we have heard a great deal of claim stories and have helped many marijuana companies acquire stable business coverage to help protect against hefty theft and vandalism damages. Our team of cannabis insurance agents recommend various loss control steps to help retail cannabis stores avoid crime claims (see below). But it is also important to remember that even the best precautions cannot always keep criminals away. And, like we always say, insurance can help protect you if the inevitable happens. So, below you will also find ballpark insurance costs for retail store securities.

Loss Control/Mitigation Steps That Cannabis Retails Stores Should Consider:

1. Avoid things that prowlers look for! (Remember: out of sight, out of mind.)

- Do not leave items in company vehicles overnight.

- Hide store window displays after hours.

- Do not leave desirable items in plain sight of building/car windows.

- Secure all desirable inventory after hours.

- During store hours, consider displaying expensive and/or easy-to-steal items in locked glass cases.

- Have store display setups that can be easily monitored by employees/cameras.

- Secure/lock up electronics like company computers during store hours and afterhours.

- Have a discrete cash register that can be emptied/locked up during closed hours.

2. Prowlers tend to target companies that…

- Are located in secluded and dark areas

- Are located in high-crime areas

- Tend to have little/no witnesses

- Have visible items to steal

- Have items that are easy to steal (i.e., small and lightweight)

- Have owners/employees with predictable routines

- Own company vehicles that are deemed easier to break into and/or steal (America’s 10 top stolen cars)

- Own company vehicles that have large gas tanks, expensive items in sight, and easily removable and/or upgraded parts

3. Have decent security cameras.

- Angle them properly. The last thing you want is footage of just the ground when a crime happens.

- Check on them regularly to make sure that they are operating and capturing properly.

- Wireless backup data drives can help keep data safe.

- Backup battery systems are helpful if the power goes out or is turned off.

- It is a good idea to have some cameras hidden and some out in the open. Doing so can help (1) deter criminals afraid of cameras, and (2) catch criminals who do not know that a camera exists. Keep in mind that criminals have been known to brake cameras, take them, or spray paint over them.

- Know your state laws regarding cameras. For instance, Washington, California, and Oregon all require marijuana businesses to have working indoor and outdoor cameras with specific resolution.

4. Alarm systems for your store and work cars.

5. Look into covering your store windows with widow film that’s virtually unbreakable.

- Here is an example.

6. Other crime deterrents for your company vehicles:

- Steering wheel locks

- Tire clamps

- Brake locks

- Keep your cars clean

- Do not leave your car running by itself

- Never leave keys in the car

- Keep all windows rolled up tightly

- Make sure doors are closed correctly

- Fix damages ASAP—especially ones to windows, doors, and trunks

- Keep the car parked somewhere secure like a company garage or what is typically deemed a “safer” area (one with good lighting and in view of security cameras)

7. Active guards on duty can be a good investment for certain businesses.

8. Have great business documentation that is organized and detailed.

- Know all the items that you are currently selling and their value.

- Keep receipts from those you acquired product from and those you end up selling to.

- Know what you put into your building/company cars and the value of each addition (such as signs, security cameras, sound systems, and other bells and whistles).

- Pictures/videos of these items are a bonus.

9. If you are a victim of theft, burglary, robbery, vandalism, and/or riot damages…

- Report the claim to your insurance company right away.

- File a police report with as much detail as you can on what was stolen, what was damaged, and if any injuries resulted from the crime.

- Take pictures of the losses/damages/injuries.

- Videos are also good to take.

- Make a list of the steps that you took to secure your store/car before the crime happened (i.e., locked doors, engaged top-of-the-line alarm systems, multiple security cameras strategically placed, locked display cases, regular security and safety checks/maintenance, etc.)

- Document the immediate steps that you took to secure your property after the crime happened (e.g., boarded up any broken windows, resecured doors, etc.)

- Save copies of the police reports (including the case number), pictures taken by the police, the names of the officer(s) who came to the scene, insurance claim paperwork, and pictures/videos in multiple areas so that they do not get lost. Flash drives are great to consider.

- Save receipts for things that you had to purchase due to the claim. For example: replacing lost product, replacing locks/glass, acquired contractor fees, etc.

Ballpark Cost to Add Money/Securities Coverage for Retail Stores:

Some important things to keep in mind:

1. Many cannabis insurance carriers have mandatory special precautions that must be followed for a loss to be covered. Make sure you know the ins and outs of your insurance policy AND adhere to all requirements. We can help you dissect your policy as well as find a carrier and policy that fits your needs.

2. Communicate with your insurance broker/agent.

-

-

- Your agent can help you determine what is and is not a covered loss.

- If you are planning some big business/property changes, your agent should be the first to know so that your policy will be updated (such as your coverage limits). Don’t wait until your renewal to give your insurance policy a dire update.

- Questions are our specialty. If you are not so sure about something, ask us!

-

3. There are different types of crime business insurance that can cover…

-

-

- Vandalism

- Theft

- Damages from Rioting

-

View our list in the next section for some examples!

Some cannabis property insurance endorsements that Mosaic can help you acquire:

In addition to helping you get physical security measures and insurance coverage, Mosaic can help you add endorsements like ones listed below to your property insurance policy. Adding these endorsements can help you have a covered theft, robbery, or vandalism claim for a specific loss. For example, an outdoor property endorsement (#2) can help replace your expensive outdoor light sign that a burglar broke when he was breaking into your store to steal merchandise

-

-

- Accounts receivable coverage

- Outdoor property insurance

- Outdoor cannabis plants coverage

- Outdoor garden plants coverage

- Money and securities insurance

- Employee dishonesty insurance

- Valuable paper and records coverage

-

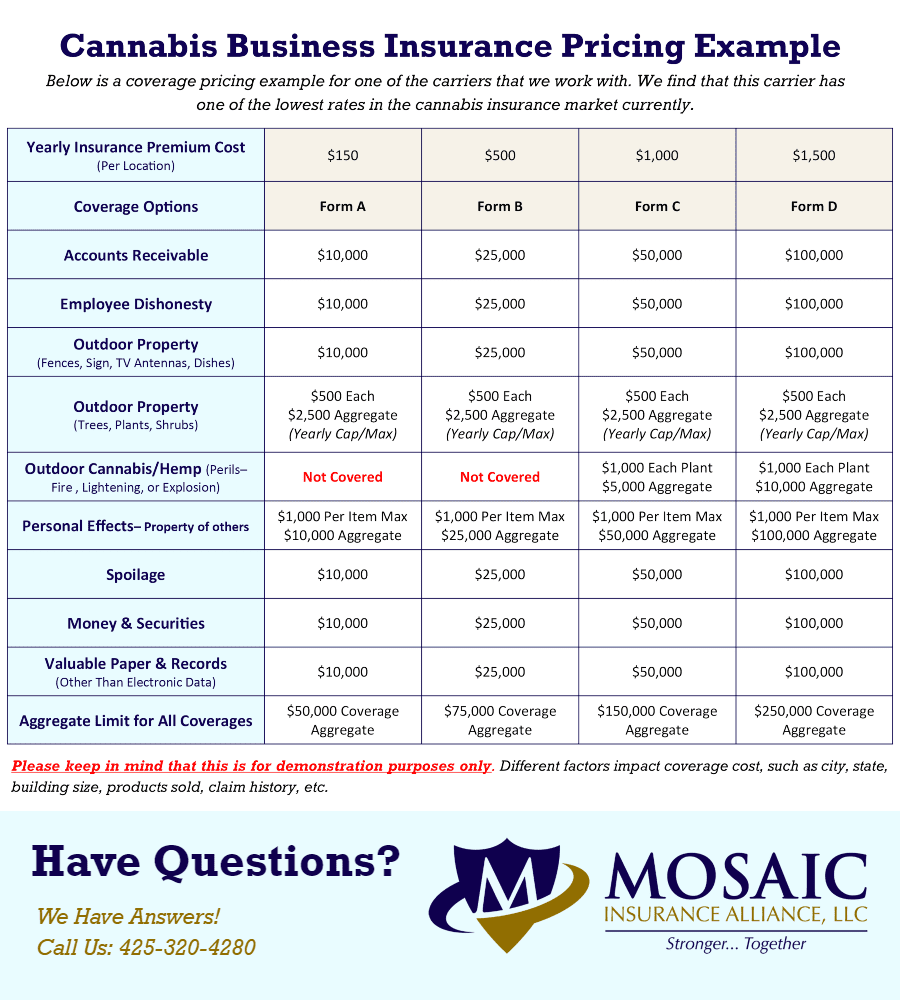

Pictured below is a current coverage pricing example from one of the carriers that we work with. We find that this carrier has one of the lowest rates in the cannabis insurance market currently. Please keep in mind that this is for demonstration purposes only. Different factors impact coverage cost, such as city, state, building size, products sold, claim history, etc. Call us for a free insurance quote, and we can run numbers specific to you. You can view this picture up-close in our PDF here.

We also have additional coverage options not listed here. If you are interested in any of the above insurance coverages or other lines, give Mosaic a call! For more theft-related insurance information, you can also check out our blog post on rioters, vandalizers, and burglars that features two short videos of our Cannabis Program Director, Steve Boone. In the videos, Steve talks about how to protect your cannabis business and what coverage options can help you. Additionally, Steve goes over some important things to know about claims that might not be covered due to theft in this other blog post here.

We love questions, and we believe there is no such thing as a stupid business insurance question.

Your marijuana business is important to us. We exist to help company owners like you get the insurance that you need. We know that marijuana insurance is a whole different universe than basic commercial insurance. That is why we have a specific team of cannabis independent insurance agents on staff.

Give us a call, or send us an email, and we will see what the next steps are to getting you stable cannabis insurance coverage for your specific coverage needs and financial needs! We are open Mon-Fri, 8:30 am to 5:00 pm Pacific Standard Time.

If you are wondering if we write insurance in your state, check out our cannabis states here.

Contacting Steve Boone, our Cannabis Program Director:

Direct Phone: 425-329-8318

Direct Email: Steve@mosaicia.com

Main Office: 425-320-4280

Main Cannabis Email: cannabis@mosaicia.com

We also have a quick and easy insurance quote form!